The PEO Solution

Small Businesses across the Country are discovering the PEO solution for hard to place Workers’ Compensation Insurance. Many business owners are unfamiliar with the system that provides the bundling services of Payroll, Human Resources, & Workers’ Compensation Insurance. A Professional Employer Organization (PEO) offers a comprehensive approach to helping business owners manage human resources responsibilities. By transferring the bulk of Human Resources related tasks, small business owners receive access to guidance and recommendations from HR specialists, all while remaining focused on the daily operations of their business, with which they are most familiar.

The issue facing many small business owners today is access to Workers’ Compensation Insurance, especially for the traditionally labor intensive industries where the risk for employee injury may be high. Although many private market insurance companies may be unwilling to work with some of the smaller companies who fall into this category, some PEO’s have carved out their niche by serving hard to place workers’ comp industries.

The issue facing many small business owners today is access to Workers’ Compensation Insurance, especially for the traditionally labor intensive industries where the risk for employee injury may be high. Although many private market insurance companies may be unwilling to work with some of the smaller companies who fall into this category, some PEO’s have carved out their niche by serving hard to place workers’ comp industries.

Different PEO’s have modeled their business to rely heavily on specific industries where their services are designed to reflect the needs of those certain business owners. Some PEO’s specialize in providing Human Resource intensive services such as legal advice and health benefits, while others have focused purely on providing cost effective Workers’ Comp and payroll flexibility. For instance, a restaurant or corporate office may be very interested in Human Resource services a PEO could provide, whereas construction contracting companies tend to be focused purely on their workers’ comp options. Whatever a business entails there is usually a PEO that is happy to provide these services and using a PEO Broker is an easy way to quickly find the PEO that may best serve a company’s primary needs.

Companies small and large are finding the benefits of contracting a PEO to be the perfect solution to their Workers’ Comp and HR related problems. The concept of outsourcing payroll is one of the most cost effective ways to manage employee related costs. Because Employee Leasing combines all payroll taxes, workers compensation, and administrative costs into one simple percentage, your ability to control cash flow, budget, and estimate jobs becomes simple. Business owners who choose a PEO over a stand-alone Worker’s Compensation Policy are able to avoid the hefty down-payments and audit fees that are associated with such policies, as well as the benefit of outsourcing payroll taxes that comes with co-employment.Co-employment occurs when a business separates the HR responsibilities and liabilities while retaining the day-to-day control of staffing and is the reason that PEO’s have recently been thriving. In this type of business relationship, your employees work for both your company and the PEO. While you maintain direct control of the work activities of your employees, the PEO assumes the administrative functions of HR and absorbs the brunt of employer-related liabilities. The PEO can also provide HR related guidance, such as creating employee and workplace policies in addition to maintaining government compliance requirements.

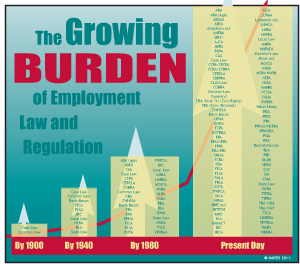

Businesses across the country have been discovering how easy it is to manage the growing burdens of Workers’ Comp and Human Resources through a PEO. For further information on how a PEO may fit the needs of your business, feel free to contact a PEO broker such as Moore Resources Insurance Agency.

Moore Resources is an Independent Insurance Agency located in St. Petersburg, FL and offering Homeowners Insurance, Auto Insurance, Personal Insurance and Business Insurance. Our reach extends beyond the Tampa Bay area to the entire state of Florida. Moore Resources has regionally been dedicated to serving the local residents of Pinellas, Hillsborough, Polk, Pasco, Manatee and Sarasota counties; including St. Pete, Tampa, Clearwater, Bradenton, Brandon, Dunedin, Gulfport, Lakeland, Largo, Lutz, Palm Harbor, Pinellas Park, Riverview, Ruskin, Seffner, Seminole, Temple Terrace, Tierra Verde, Town n Country, and the Gulf Coast Beaches.

Please remember that the purpose of this blog is to present general information only. It does not interpret specific policies or coverage. In order to obtain detailed information regarding your insurance, contact a licensed insurance agent.